Amazing Tips About How To Detect A Fraudulent Check

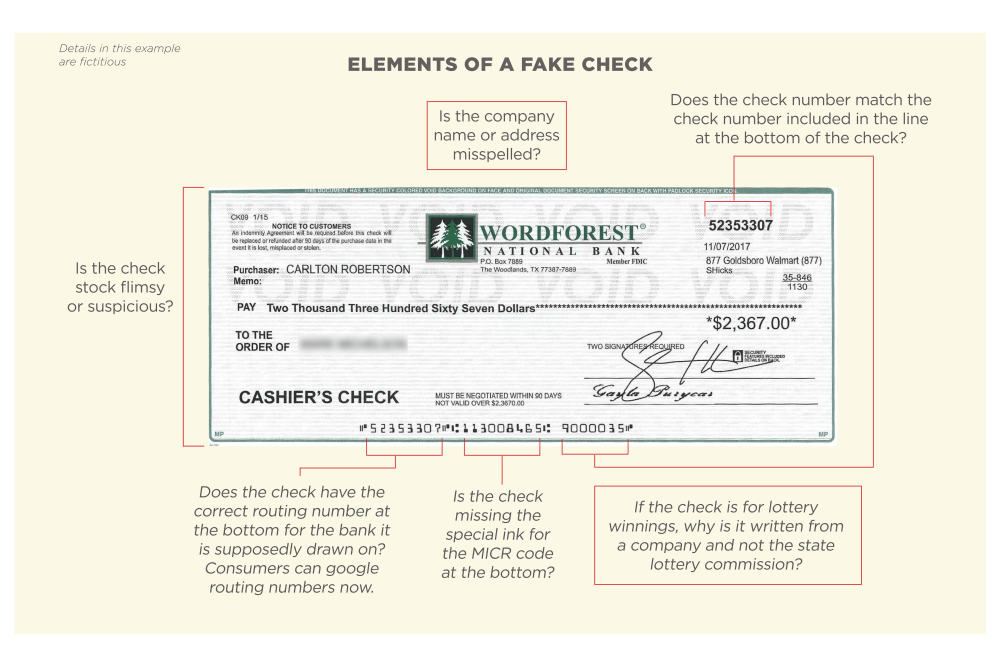

The check number is low, such as 0 to 400 on personal checks or 1001 to 1500 on business checks.

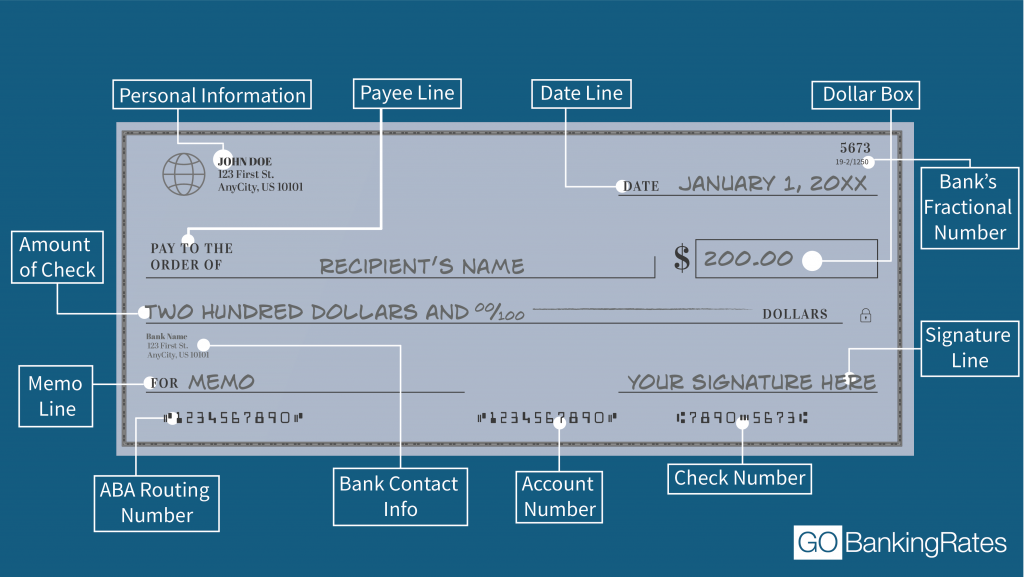

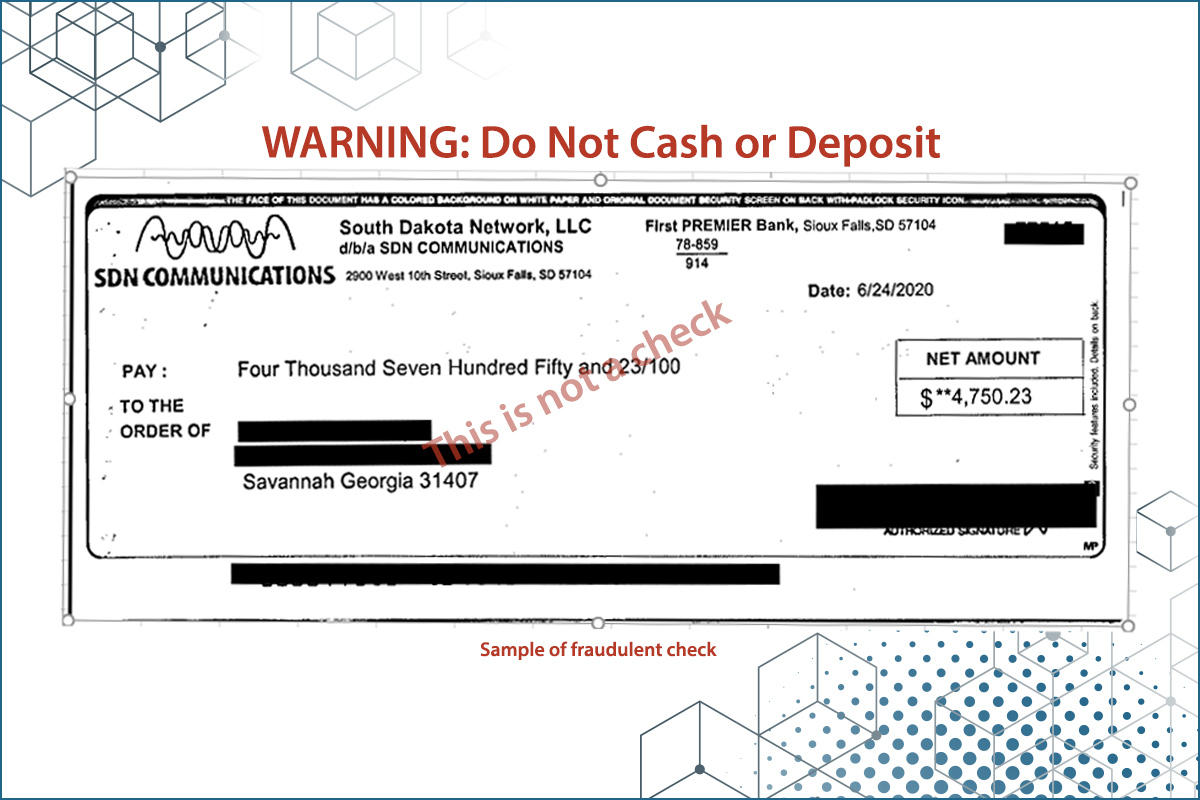

How to detect a fraudulent check. Whereas real checks are typically printed on sturdy stock paper, fake ones are often thin and flimsy. Fake checks take weeks to discover. Here are some indications that a check may be fraudulent:

The first and most basic method of spotting a fraudulent website is to make sure the domain name is the one you truly intend to visit. The thickness of the paper may also expose a fake check. Transaction fraud is typically detected through employee tips, internal audits, management reviews, and accidental discovery.

Occasionally, these checks are stolen. Organizations can also conduct external. Up to 20% cash back use cases.

If the cvv entered at the. If you’re already using truechecks® to scan your mobile deposits automatically, then you’re in better shape than most fis out there. Fake checks and your bank.

Bank tellers should know how to visually assess a check for signs of fraud, but you should also invest in machine learning software that can identify fraud flags based on the look of the. By law, banks have to make deposited funds available quickly, usually within two. Card verification value (cvv) — the three numbers on the back of a card take merchants a step closer to identifying online fraud transitions.

Look for the padlock, then look harder. Look to see where the check was mailed from. If the postmark is not the same as the city and.

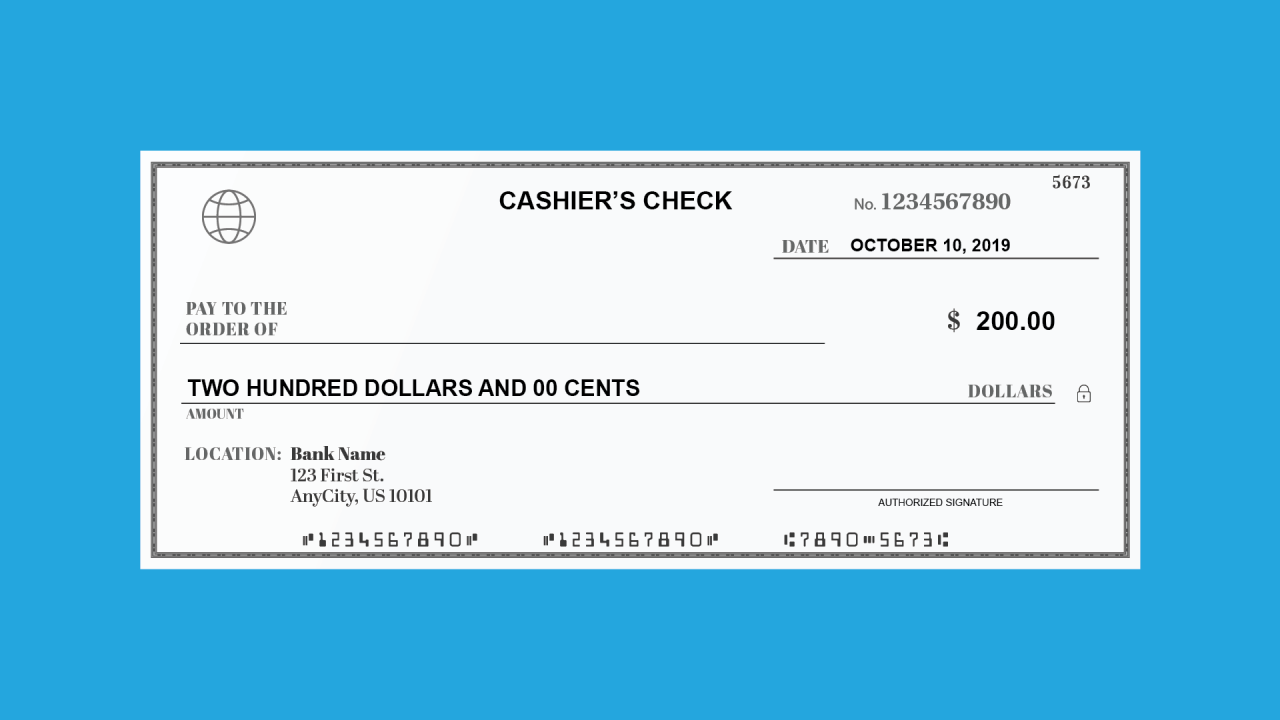

/cdn.vox-cdn.com/uploads/chorus_asset/file/18995632/Cashier3.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/18995632/Cashier3.jpg)