Real Info About How To Avoid Currency Risk

In conclusion, 2.457,4 euros in losses which will reduce your profit margin and which could easily have been avoided with the help of a bx currency broker and the use of a.

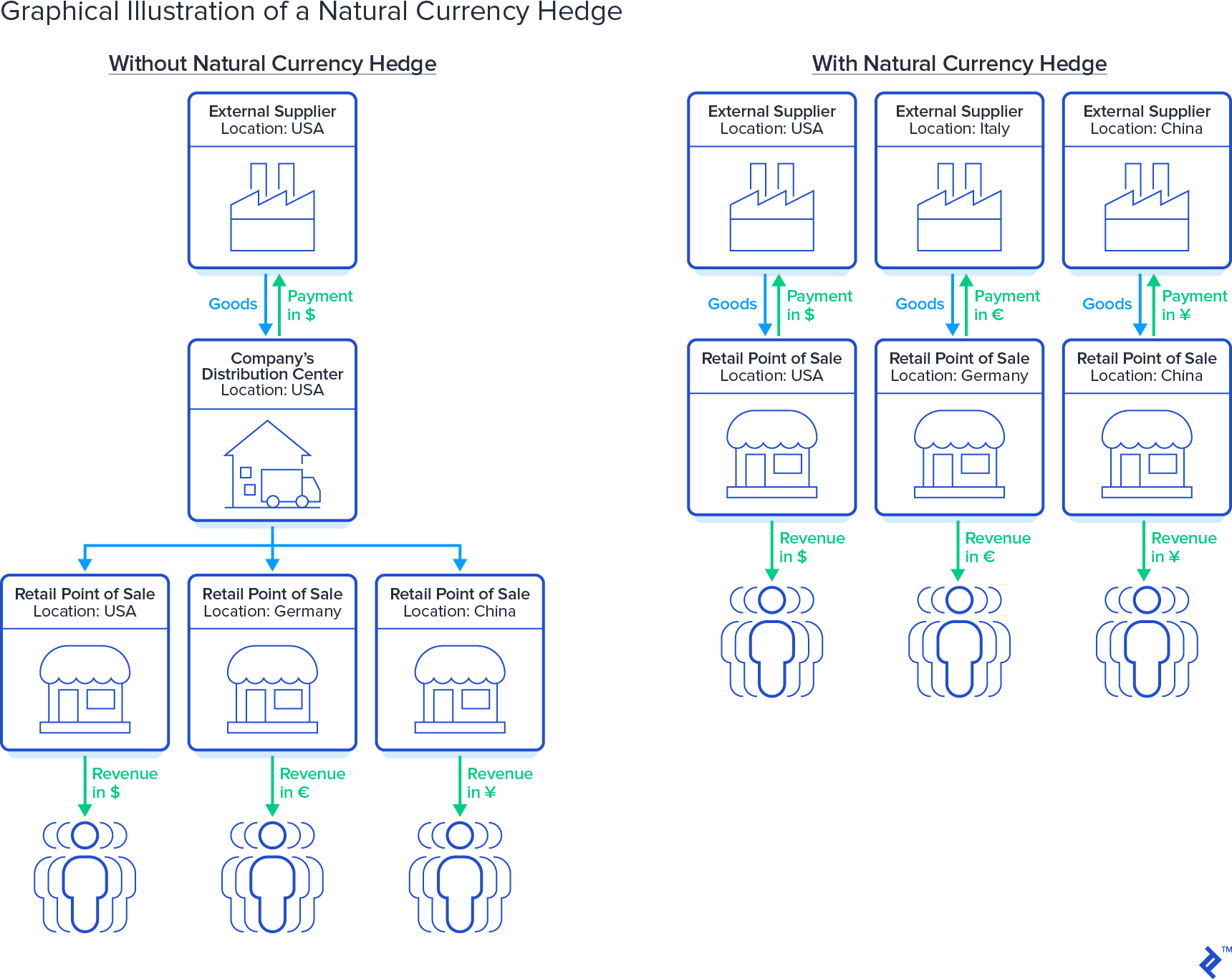

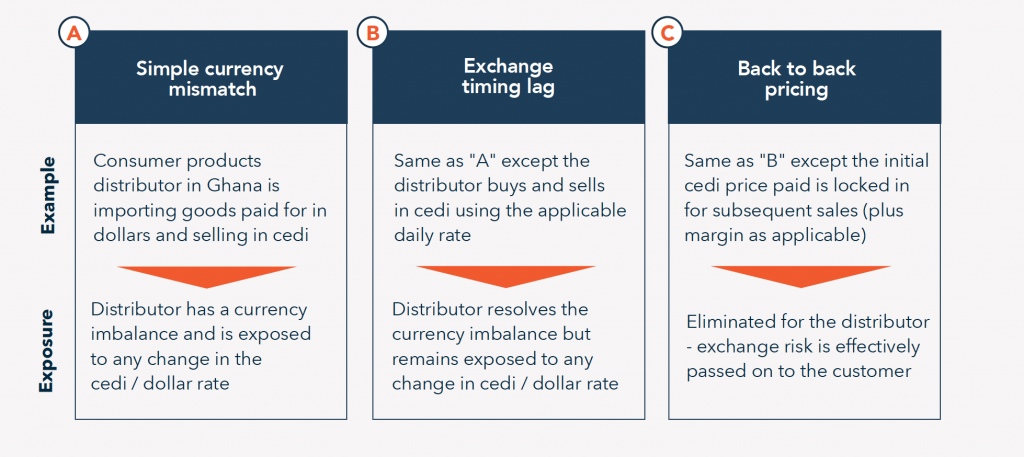

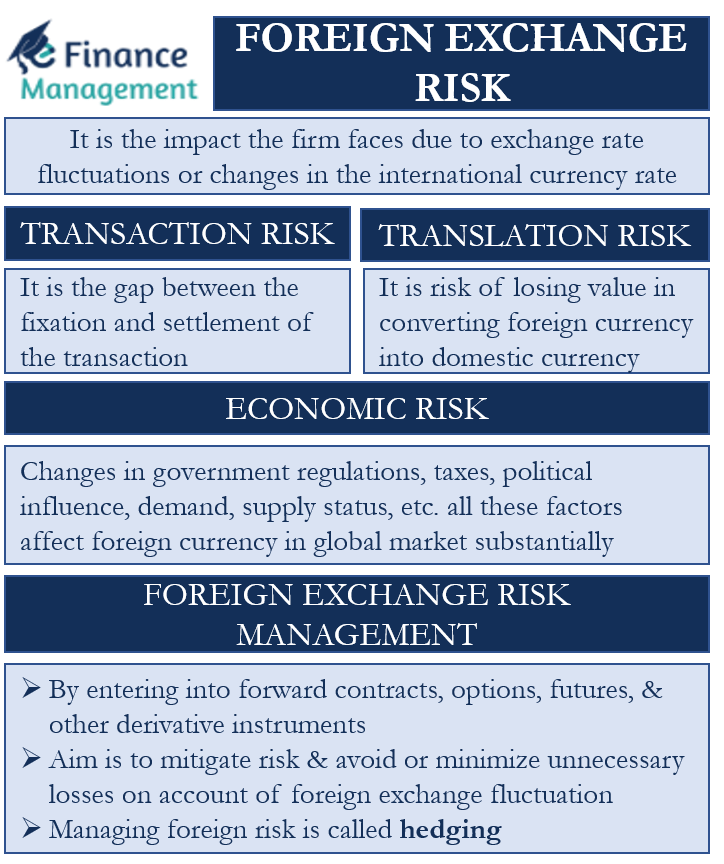

How to avoid currency risk. Exchange rate risk cannot be avoided altogether when investing overseas, but it can be mitigated considerably through the use of hedging techniques. 5 ways to reduce your exposure to currency risk 1. 5 steps to manage your business’s currency risk 2.

Currency forwardcontracts are another option to mitigate currency risk. How to handle currency risk of etf. Buy an s&p 500 index fund.

A forward contract is an agreement between two parties to buy or sell a currency at a preset exchange rate and a predetermined future date. Here are the steps to hedge against currency risk with an etf: These funds remove the risk for you, so you only have to worry about.

For example, if an investor from the us purchases a bond predominated in. To eliminate forex risk, an investor would have to avoid investing in overseas assets altogether. One of the simplest ways to avoid the risks associated with fluctuations in exchange rates is to quote prices and require payment in u.s.

There are two ways to hedge: However, exchange rate risk can be mitigated with currency forwards or. When you want to avoid taking the unnecessary risk of exposing your business to currency fluctuation.

The standard & poor’s 500 index is a collection of hundreds of america’s top companies,. If you pay your payments in pounds, you should invest more. By hedging your currency exposure, you actually benefit in full from the capital appreciation of your property, regardless of what happens on the foreign exchange markets.

/GettyImages-157380238-de8368377d114242af29d2d670382aa6.jpg)

%20(002).png)